United States

Helping ambitious businesses act with confidence.

Freshfields is the leading firm for complex US corporate, litigation and regulatory work, ranked Band 1 globally by Chambers across the seven areas of antitrust, corporate/M&A, dispute resolution, international arbitration, crisis management, tax and public international law.

Our US team comprises more than 400 lawyers across New York, Silicon Valley and Washington, DC, with the majority of our partners recognized by premier legal directories, including Chambers (Band 1), Legal 500 and Benchmark Litigation, among others.

Our practice features a concentrated depth of expertise in the key legal disciplines most important to global businesses across transaction, regulatory and risk, including: corporate/M&A, antitrust, international arbitration, commercial litigation, securities and shareholder litigation, investigations, white collar, corporate advisory and governance, regulatory and compliance advisory, capital markets, leveraged finance, private capital, restructuring and capital solutions, CFIUS and foreign direct investment, sanctions, life sciences transactions, AI, cybersecurity and data privacy, IP/data transactions, financial services regulatory, structured products and derivatives, employee benefits and compensation and tax.

These strengths, combined with the knowledge, experience and energy of more than 2,800 lawyers and other legal professionals across 29 offices, have helped us build a reputation for breaking new legal ground, handling the highest-profile matters and solving our clients’ most complex corporate, regulatory and litigation challenges in the US and internationally.

In short, we offer everything our clients need to make decisions quickly and with confidence: a global perspective, local knowledge, and sophisticated advice in any jurisdiction.

Recent US work

- 3M Company, several officers, and directors in securities class action and related shareholder derivative suits based on alleged failure to disclose contingent environmental liabilities; both suits dismissed with prejudice.

- AstraZeneca on numerous matters, including its $1.1 billion acquisition of Icosavax and acquisition of Gracell Biotechnologies, and in securities class action challenging statements regarding clinical trial of its COVID-19 vaccine; motion to dismiss granted and affirmed on appeal.

- BBVA in a landmark win in excess of $100 million in an ICSID Additional Facility arbitration against Bolivia arising out of government measures nationalizing the pension fund administration service provided by BBVA’s Bolivian subsidiary.

- Blackstone portfolio company, Schenck Process Group, on the sale of its food and performance materials business to Hillenbrand.

- Cazoo on a series of restructuring transactions which significantly deleveraged the company’s capital structure.

- Comcast NBCUniversal’s subsidiary The Golf Channel as a third party in LIV Golf’s antitrust litigation against the PGA Tour.

- ConocoPhillips on an ICSID arbitration under the Netherlands-Venezuela BIT, arising out of one of the largest expropriations in history (victory on the merits for over $8.7 billion in damages).

- Coupa on its $8 billion take-private by Thoma Bravo.

- HPE on numerous acquisitions, and on the antitrust aspects of its $14 billion acquisition of Juniper.

- Indivior PLC on its additional listing on NASDAQ.

- KfW IPEX-Bank as lead arranger and lender for the limited recourse financing of an ammonia fertilizer plant in Topolobampo, Mexico, expected to be the largest in Latin America.

- Qualtrics committee of independent directors of the board on the $12.5 billion all-cash sale of the company to a private equity consortium.

- Occidental Petroleum in an UNCITRAL arbitration against Venezuela following Venezuela’s improper interference with OXY’s hydrocarbons investments, obtaining an award in excess of $100 million (and costs).

- Oracle Corporation on several billion dollars’ worth of debt offerings and credit facilities.

- Novartis, as global transaction counsel, on the separation and spin-off of Sandoz, its generics and biosimilars division.

- Roivant Sciences on the $7.1 billion sale of Telavant to Roche and near-term milestone payment of $150 million in cash.

- The underwriters of Samsara on its $805 million IPO on the NYSE.

- TriNet on its private offering of senior notes and new revolving credit facility, and on several acquisitions.

- A global financial institution on parallel investigations by the US DOJ, SEC and UK FCA in connection with allegations of corruption, money laundering, and fraud arising out of $2 billion in failed infrastructure loans to an African nation.

- A multinational life sciences company in securing a settlement with the SEC and declination from the DOJ, resolving a five-year FCPA investigation into the company’s relationships with healthcare professionals in China and globally.

Our team

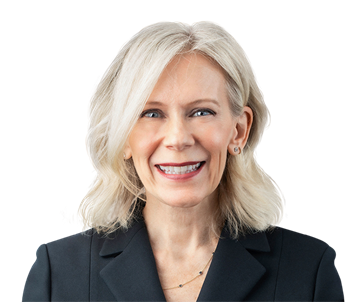

Gayle Klein Co-head of US litigation, arbitration and global investigations

New York, Silicon Valley

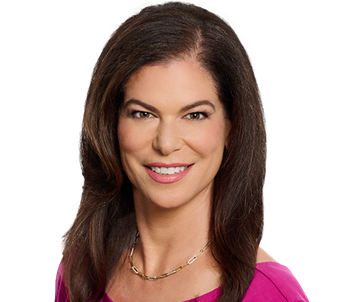

Pamela L. Marcogliese Head of US Transactions

New York, Silicon Valley

Jamillia Ferris US Head of antitrust, competition, and trade

Washington, DC

Noiana Marigo Global Co-Head of International Arbitration & Co-Head of Latin America Practice

New York

Beth George Partner

Silicon Valley

Aimen Mir Partner | Foreign Investment and National Security | Head of CFIUS Practice

Washington, DC

Nabeel Yousef Partner

Washington, DC

David Sewell Partner

New York

Menachem Kaplan Partner

New York

Mark F. Liscio Partner

New York

Lori D. Goodman Partner

New York

Nicole F. Foster Partner

New York

Claude Stansbury Partner

Washington, DC, Silicon Valley

Melissa Raciti-Knapp Partner

New York

Brian Rance Partner

New York