News

Freshfields advises on US$1.8bn Hong Kong primary listing and US SEC-registered offering of XPeng Inc.’s shares

Freshfields Bruckhaus Deringer (‘Freshfields’) has advised a group of underwriters led by J.P. Morgan Securities (Asia Pacific) Limited and Merrill Lynch (Asia Pacific) Limited on the US SEC registered offering and HKSE primary listing of Xpeng Inc.’s shares. The deal raised gross proceeds of approximately US$1.8bn (before the exercise of the Over-allotment Option).

XPeng Inc. is one of the China’s leading smart electric vehicle (‘EV’) companies. With leading software, data and hardware technology at its core, the company brings innovation in autonomous driving, smart connectivity and core vehicle systems.

This dual-primary listing in Hong Kong follows XPeng Inc.'s NYSE listing less than a year ago and could pave the way for other similarly-situated US-listed Chinese issuers to seek a listing in Hong Kong. The company is the first dual-primarily listed company in Hong Kong with a weighted voting rights structure.

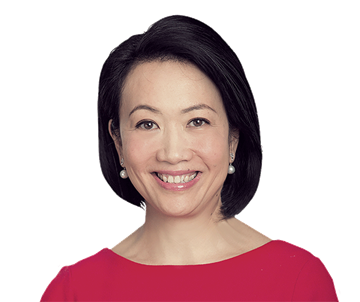

A multidisciplinary Freshfields team drawn from our Hong Kong, New York, Washington, D.C. and Beijing offices advised on the transaction, led by partner and China Chairman Teresa Ko and U.S. partner Calvin Lai. They were supported by partners Michael Levitt, Nabeel Yousef, Linda Martin and Claude Stansbury; head of Asia financial services Matthew O’Callaghan; and counsel Steven Hsu, David Yi, Jeremy Barr and Stephanie Brown Cripps.

ENDS

Notes to editors

About Freshfields Bruckhaus Deringer

Freshfields Bruckhaus Deringer LLP is a global law firm with a long track record of successfully advising the world's leading national and multinational corporations and financial institutions on ground-breaking and business-critical challenges. Our team of more than 2,800 lawyers and other legal professionals delivers global results from our 28 offices worldwide. Our commitment, local and multinational expertise and business know-how means our clients can rely on us when it matters most.