Energy transition: the current landscape in Latin America and what to expect in 2023

As we leave behind the global crisis created by the pandemic, governments and civil society are refocusing on achieving climate and sustainable development goals, for which the energy transition is key.

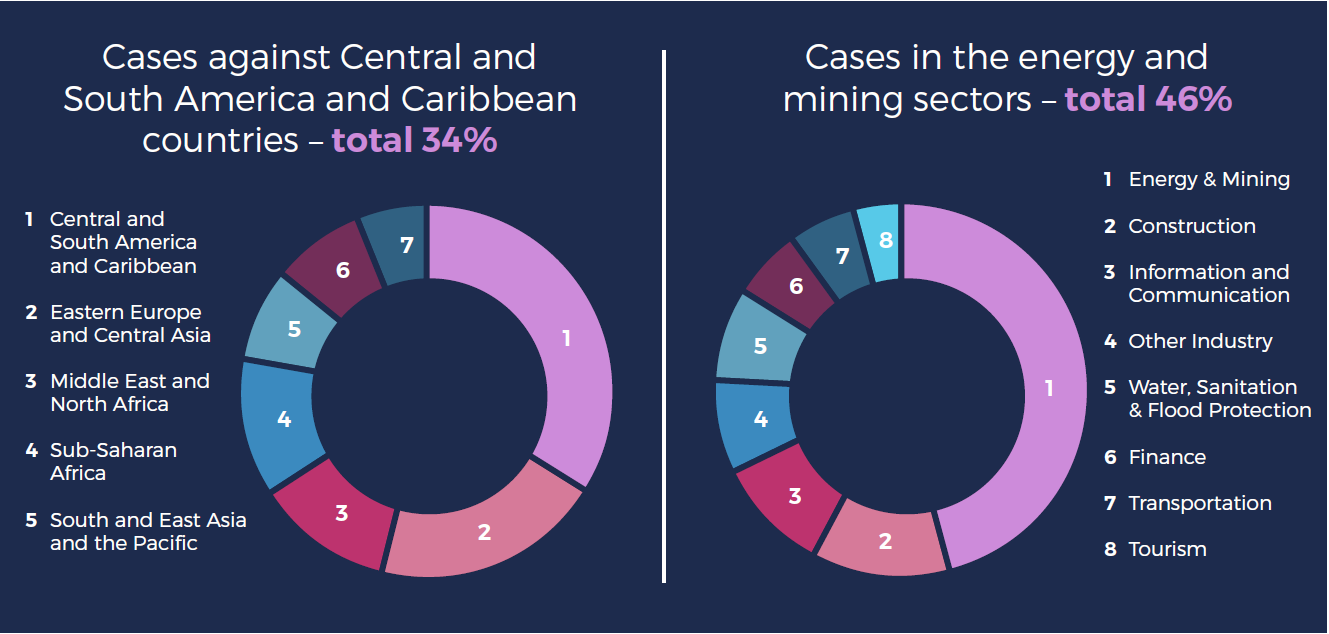

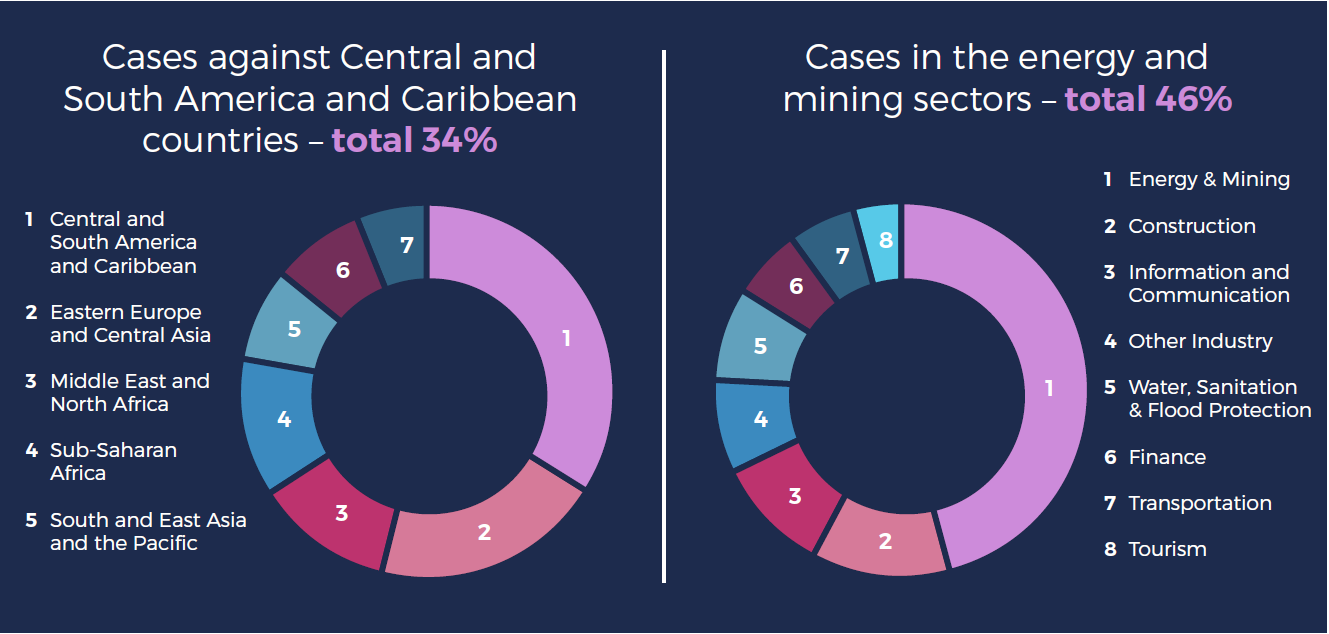

In Latin America, the transition presents both opportunities and challenges, which are likely to increase the number of energy-related disputes in the region in 2023. Disputes in the sector are commonly settled by arbitration, including investment arbitration. According to the latest ICSID report, almost half of the ICSID cases in 2022 were related to energy and mining sectors, and one out of three cases registered involved Central or South America or the Caribbean countries.

Efforts to incentivise investment in clean energy generation in Latin America in the past decade yielded positive results. Between 2015 and 2020, Latin American countries increased their renewable capacity by 33 per cent. For example, Costa Rica and Uruguay are already almost entirely self-sufficient in energy through the development of renewables. Moreover, 15 countries in the region have committed to source 70 per cent of their electricity demand from renewable sources by 2030. These countries are part of the Renewables in Latin America and the Caribbean (RELAC) initiative, which was created at the end of 2019, within the framework of the United Nations Climate Action Summit. Its members are Bolivia, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Haiti, Honduras, Nicaragua, Panama, Paraguay, Peru and Uruguay. In this context, Latin American governments have established specific regulatory regimes to attract foreign investments into the sector. Failing to maintain such regimes, or introducing significant regulatory changes to those regimes, may breach protections granted to investors under international investment treaties and free trade agreements.

This transition will be impacted by recent events that have disrupted international energy markets, including the COVID-19 pandemic and the Russian invasion of Ukraine, which have caused fossil fuel prices to spike. Several Latin American countries have seized on the opportunity by investing in their oil and gas (O&G) industry in an effort to reactivate their economies. This may motivate governments to put green energy policies on hold, potentially leading to new disputes.

For example, the Mexican government under the leadership of President López Obrador is backtracking on its policies to develop private investment in renewable energy in order to re-impose domination of State-owned companies such as Pemex (oil and gas) and CFE (electricity) in the energy sector. Since these State-owned entities are largely dominated by fossil fuel development and (in the case of CFE) thermal power plants, the transition to cleaner energy has effectively stalled. Regulatory changes to the renewables sector may put Mexico in a position similar to that of Spain and Italy, which faced multiple investment treaty claims after revoking incentives given to the renewable energy sector.

Recently re-elected Brazilian President Lula has indicated a tendency similar to that of Mexico and wants Petrobras (the State-owned O&G company) to regain its market-leading position in the industry, especially in downstream operations. The sector can expect an increase in government investment. A more aggressive Petrobras and the current volatility in oil prices will likely lead to commercial disputes. Brazilian energy companies have largely preferred to resolve their disputes through arbitration, and so we can expect to see an increase in Brazil-seated energy arbitrations.

Other tensions are arising as a consequence of political changes. For example, Colombia is one of the world’s biggest coal exporters and is currently exporting coal at record levels. Similarly, it is a new exporter of oil and gas through State-controlled energy company Ecopetrol. However, newly elected President Petro has openly declared his fierce opposition to the O&G and mining industries with commitments not to grant new exploration licenses and not to develop fracking, which would have a severe impact on State revenues. This is being partially offset by a major tax reform that has increased the tax take from natural resources (eg by rendering royalties non-deductible for tax purposes).

In contrast to Colombia’s position, Argentina has embraced fracking and is seeking to increase production of O&G at its mega-deposit, Vaca Muerta, which holds the world’s second-largest shale gas reserves and the world’s fourth-largest shale oil deposits. Environmental concerns over shale exploitation may lead to disputes. Argentina has also sought, along with Bolivia and Chile, to expand the mining of lithium – lithium is key to energy transition and will certainly be in the spotlight in 2023. Given the environmental impacts associated with shale exploitation and lithium mining, as well as the element’s strategic importance (eg Mexico recently nationalised lithium), the region is likely to see lithium-related disputes in the near future.

Finally, the global thirst for energy may have a potential upside for investors in Venezuela. The current geopolitical situation that has cut off Russian oil from international markets has allowed Venezuela to resume its diplomatic relations with certain countries, including Colombia and Spain. Approvals have been granted to European oil companies to deal in Venezuelan oil. If the US decides to ease sanctions further, Venezuela may be seeking a new inflow of foreign investment into the sector.

In summary, Latin America is at a crossroads. As a region where many countries’ wealth depends on exploiting natural resources (including large-scale mining of coal and development of oil and gas), the energy transition presents a unique challenge. Some countries such as Mexico and Brazil seem to be doubling down on their historic reliance on fossil fuels, whereas others, such as Colombia, have apparently embraced the need for a transition despite the likely cost. Considering that disputes flourish in times of transition as well as Latin America’s preference for resolving disputes through arbitration, we expect the region to generate many new cases in 2023.