International Arbitration Top Trends 2023

Withdrawal from the ECT: one step forward, two steps back?

In 2022 several EU Member States announced their intention to abandon the ECT. This came at a time when the ECT modernisation process that was started in 2017 had just been concluded – with the vote on the adoption of its modernised text being the only outstanding issue. Given the announced withdrawals, the vote was postponed to April 2023. Where do investors stand?

With a view to aligning their ECT obligations with their new energy transition and climate change strategy, the 53 ECT Contracting Parties reached an agreement in principle to modernise the treaty. The proposal includes (i) a revised list of protected energy investments, (ii) the exclusion of intra-EU arbitrations, in line with the case law of the European Court of Justice, and (iii) an opt-out mechanism allowing States to exclude new fossil fuel investments from treaty protection.

The proposal also reaffirmed the States’ right to adopt measures for environmental protection and boost the energy transition. However, several EU Member States now seem to have taken the position that these achievements are not enough.

Why are EU Member States exiting the ECT?

Calls for modernising the ECT came after a slew of investment claims targeting environmental measures and climate policies. In 2012, Swedish Vattenfall sued Germany over the phaseout of nuclear energy in the aftermath of the Fukushima incident.

The Netherlands faced a similar fate when deciding to implement its coal-exit policy, planning to phase out all coal-fired power plants by 2029. Relying on the ECT, the German companies RWE and Uniper are reportedly seeking approximately €2.5bn in damages from the Dutch State. More recently, an arbitral tribunal ordered Italy to pay €190m plus interest to the English-incorporated oil and gas company Rockhopper for banning exploration and exploitation of oil concessions in the Adriatic coast due to environmental concerns.

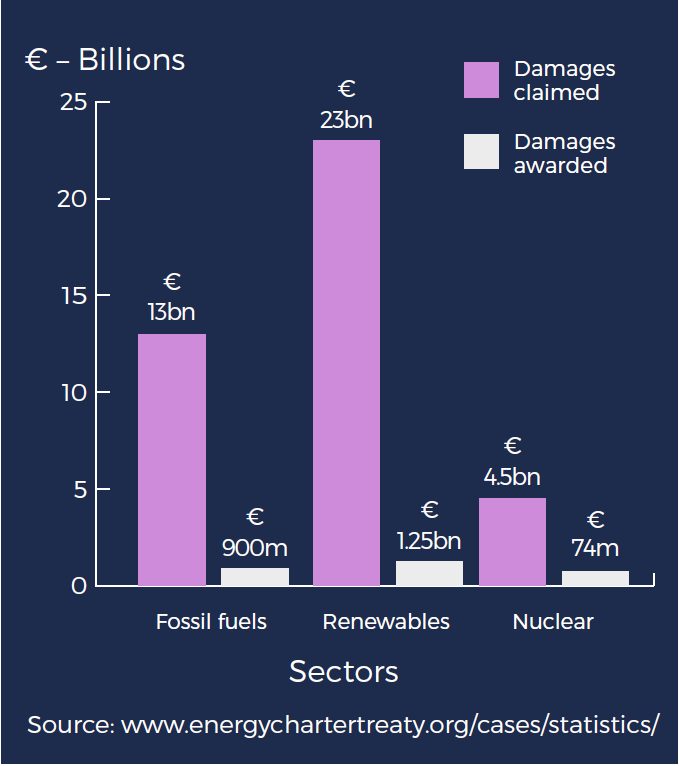

Yet the ECT does not only protect conventional investments. The vast majority of claims against EU Member States have been brought by renewable energy investors. Since 2010, Spain, Italy, Czech Republic, Germany and France – amongst others – faced more than 60 investment arbitration cases worth more than €10bn after cutting or reviewing incentives to renewable energy producers.

This wave of investment claims raised the issue of the balance between investment protection and States’ right to regulate to pursue their policy goals, especially those concerning energy transition and climate change. Redefining this balance was one of the very objectives of the ECT modernisation process.

However, some EU Member States seem to be dissatisfied with the outcome reached. They considered the proposed reform insufficient. Against this background, last year Belgium, France, Germany, Luxembourg, the Netherlands, Poland, Portugal, Slovenia and Spain announced their intention to withdraw from the ECT. Shortly thereafter, the European Parliament even called for a coordinated withdrawal of all EU Member States.

What is next for the ECT, and where do investors stand?

Withdrawals from the ECT trigger the application of the so-called sunset clause. The ECT sunset clause extends the protection of existing investments (including those in conventional energy sources) for a period of 20 years following the withdrawal.

This is why the EU is seeking a coordinated withdrawal of EU Member States from the ECT in an attempt to neutralise the operation of the ECT sunset clause. However, the legal effects of such a coordinated withdrawal are far from certain under international law. It will be left to arbitral tribunals to determine whether – after a coordinated withdrawal of EU Member States – the ECT sunset clause applies or not with respect to prior investments made in such EU Member States.

Against the backdrop of this potential significant shift in the European energy investment landscape, investors in the EU energy sector should carefully consider a number of factors to ensure protection of their investments against unlawful government intervention.

- Investment structuring to ensure optimal legal protection: Investors should carefully evaluate how to structure and/or restructure their investments in the EU. It may be advisable to invest from an entity located in a jurisdiction outside the EU (eg Switzerland or the UK) with good investment protection treaties in force with the EU Member State in which the investment is made.

- Assessing alternative instruments to protect their rights: Investors should consider the possibility of concluding or amending investment contracts with the relevant EU Member State – or one of its agencies – in order to include arbitration clauses and substantive protections in these instruments. It is paramount that the seat of arbitration is located outside the EU. Moreover, investors should carefully assess the specific alternative legal protections available to their investments – under national law, EU law, other investment protection treaties or the European Convention on Human Rights.

- Leveraging their position for negotiations: The cost of arbitration proceedings as well as the risk of reputational damages may incentivise States to settle their disputes with investors. The Vattenfall arbitration against Germany is a good example of that, in which the parties managed to reach an agreement worth over €1.4bn in lieu of a decision of the tribunal. Investors should therefore always be prepared to leverage their position in negotiations with States and State entities in order to mitigate litigation risk.

‘Energy investors must prepare themselves in light of the announced withdrawal of several EU Member States from the ECT. The risk of being left without proper legal protection from government intervention – especially in certain countries – is too high. The specific situation of each investment must be carefully assessed with a view to ensure optimal legal protection and mitigate risks as much as possible.’

Carsten Wendler, Partner

- Introduction

- Arbitration arising out of Russia’s invasion of Ukraine

- The global supply chain crisis and construction arbitration

- LNG disputes gather on the horizon amid market volatility

- Energy transition: the current landscape in Latin America and what to expect in 2023

- Withdrawal from the ECT: one step forward, two steps back?

- Drive towards greater transparency

- Progress towards diversity continues to gather pace

- Reform of the Arbitration Act 1996

- Section 1782 discovery: some answers, but more questions

- International arbitration in the life sciences sector

- Data protection and cybersecurity in international arbitration remain in the spotlight

- Increasing ‘internationalisation’ of tax disputes